Table of Contents

Labor Theory of Value: Unlocking the Astonishing Secret of Economic Worth

The question of economic value has confounded thinkers for millennia. We navigate a complex world where essential resources, such as fresh water, flow abundantly and are priced cheaply, yet non-essential items, like a polished diamond, command astronomical sums.[Read] This profound discrepancy forces us to look beyond immediate utility and ask: What, fundamentally, determines a product’s true economic worth?

For centuries, economists sought an objective, structural answer to this riddle. They conceived of the Labor theory of value (LTV), a sophisticated explanation asserting that the exchange value of a commodity is determined by the total amount of human labor required for its production.[Read] While the LTV has a long lineage, originating with classical giants like Adam Smith and David Ricardo, it found its most explosive and transformative articulation in the social critique developed by Karl Marx. The LTV, therefore, stands not merely as an abstract economic formula, but as a deep philosophical lens through which the structural foundations of wealth, profit, and exploitation in market economies must be analyzed.

Tracing the path of the Labor theory of value reveals a fascinating intellectual history, marked by breakthroughs and inevitable inconsistencies. The evolution of this concept from a rudimentary measure of wealth to a comprehensive theory of capitalist dynamics forms the essential backbone of modern critical political economy. This analysis will journey through its classical origins, dissect the profound mechanics of Marxist value creation, address the seismic challenge posed by the subjective theory of value, and explore the compelling relevance of the LTV in dissecting the complex labor relations of the 21st-century global economy.

The Classical Foundation: Smith, Ricardo, and the Dawn of the Labor Theory of Value

The Labor theory of value first gained prominence during the 18th and 19th centuries, largely due to the rigorous intellectual efforts of the classical economists.[Read] These thinkers grappled with the distinction between the utility of a good and its market price.

Adam Smith and the Paradox of Price

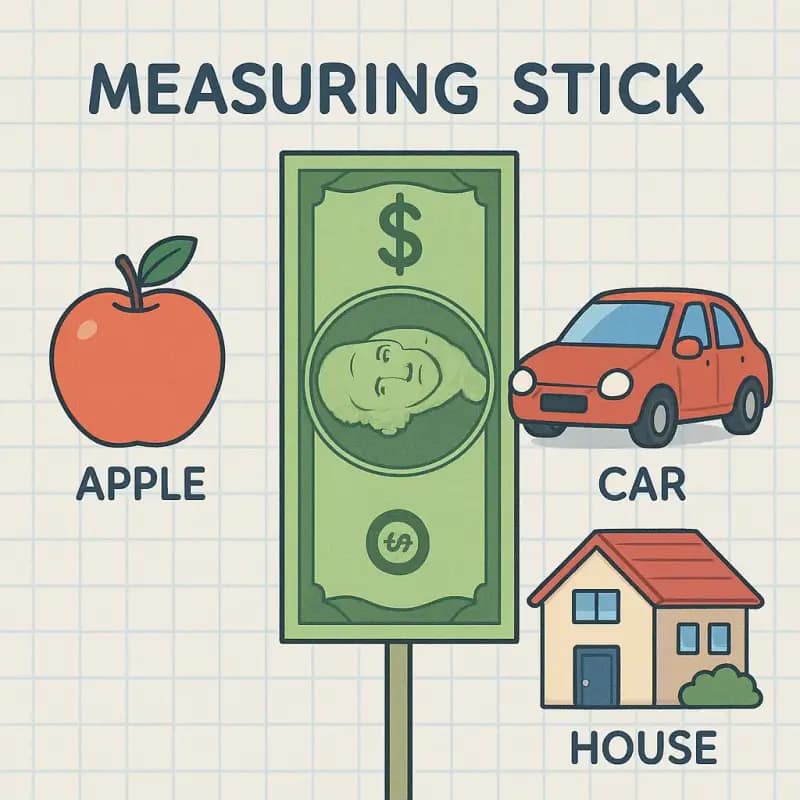

Adam Smith, often regarded as the father of modern economics, formally outlined the diamond-water paradox. Smith recognized the divergence between a commodity’s use-value (its utility—water is vital) and its exchange-value (its purchasing power—diamonds are expensive). He argued that labor served as the natural measure, or “real price,” of a product, independent of the fluctuating value of money.[Read]

However, Smith restricted the universal application of the LTV. He maintained that the LTV held true primarily in the “early and rude state of society”. In a modern economy, where owners of capital required compensation in the form of profit, Smith concluded that the LTV could not fully account for exchange ratios. His focus shifted to “labor commanded,” seeing the price of a commodity as a reflection of how much labor it could “save” the purchaser, rather than the amount of labor actually embodied in the product itself. This limitation meant Smith ultimately made “little use” of the LTV in analyzing advanced capitalist markets.

David Ricardo’s Attempt at Generalization

David Ricardo adopted a more ambitious stance, striving to generalize the Labor theory of value to apply robustly within the capitalist structure. Ricardo argued that the relative values of different commodities should be proportional to the labor necessary to produce them. Crucially, unlike Smith, Ricardo included the labor components necessary to develop physical assets and tools used in production—what Marx later termed dead labor.

Ricardo recognized, though, that even his generalized formulation had exceptions. For example, he noted that the value of well-aged wine increases as time passes, despite the absence of any additional labor input during the aging process. This inconsistency, alongside other complications related to the rate of profit, led Ricardo to express his dissatisfaction with his own explanation of the principles regulating value.

The classical economists’ difficulty in consistently applying the Labor theory of value to a capitalist system marked a critical turning point. Smith’s introduction of labor as a stable measure of value, followed by his inability to reconcile it with profit maximization in advanced economies, highlighted a fundamental conceptual tension. These thinkers recognized human labor as the logical source of objective value but could not fully bridge this objective measure with the observable reality of market price fluctuations driven by the accumulation of capital. This unresolved tension provided the analytical space for Karl Marx to develop his far more encompassing theory of value and social critique.

A concise overview of how the LTV developed within classical thought.

Table 1: Evolution of the Labor Theory of Value (LTV) in Classical Thought

| Concept | Adam Smith’s View | David Ricardo’s View |

| Primary Measure | Labor Commanded (Purchasing Power) | Labor Embodied (Labor Time) |

| Application Scope | Limited to the “early and rude state” of society. | Generalized to capitalism, but with acknowledged exceptions. |

| Inclusion of Past Labor | Generally excluded, not implicating capital components. | Included, encompassing indirect labor components (tools/assets). |

| Primary Goal | Measuring wealth/Real Price. | Establishing labor as the primary determinant of long-run prices. |

The Marxist Magnification: Unveiling Exploitation and Surplus Value

Karl Marx’s work fundamentally shifted the purpose of the Labor theory of value. For Marx, the LTV was not merely a pricing formula but the core of his “critique of political economy”.[Read] His goal was to analyze capitalist social relations, specifically revealing the source of profit and the mechanism of exploitation.

Abstract Labor and Socially Necessary Labor Time

Marx began by analyzing the commodity. He observed that a commodity must possess both use-value (it must satisfy a human want or need) and exchange-value (it must be quantifiable and tradable).[Read] While use-value is a prerequisite for exchange, it cannot determine its magnitude (the paradox of value confirms this).

To have exchange-value, commodities must be comparable, requiring a common element or substance by which they can be measured. Marx identified this common substance as labor, but not in its concrete form (e.g., tailoring or weaving). He posited abstract labor—undifferentiated, homogeneous human labor measured purely by duration, or labor-time. This abstraction obliterates the individual characteristics of the worker and their specific craft, reducing all human effort to a quantifiable expenditure of energy. This is the essence of value creation.

This abstract labor is quantified as Socially Necessary Labor Time (SNLT). SNLT is defined as the amount of labor required to produce a commodity under the average prevailing conditions of production, utilizing the average skill and intensity available in society. If a specific producer uses antiquated machinery and takes twice as long as the social average, the commodity’s exchange value is still determined by the SNLT, not the individual’s inefficiency. This concept links value inextricably to productivity and competitive pressures.[Read] Crucially, Marx noted that if no market demand or use-value exists for a product, then no labor involved in its creation can be deemed socially necessary, and consequently, no value is produced.[Read]

Decomposing Capital and Creating New Value

To trace the creation of new value, Marx categorized the capital invested by the capitalist into two distinct components:

Constant Capital ©: This includes non-human inputs such as raw materials, buildings, and machinery. It represents past labor—or dead labor—embodied in these means of production. Constant capital merely transfers its pre-existing value into the final commodity; it does not create any new value.[Read]

Variable Capital (V): This represents the wages paid to the workers. Marx theorized that the wage is payment for the worker’s labor power (their capacity to work), the value of which is determined by the SNLT required to reproduce the worker (i.e., the cost of their subsistence). Variable capital is the only component that can add new value, making it the living labor component.

The Source of Surplus Value

The core insight of the Marxist Labor theory of value is the explanation of surplus value (S), the source of profit.[Read] The worker is paid the value of their labor power (V). For example, if a worker can produce the value equivalent of their weekly wages in four hours (the necessary labor time), the capitalist has purchased the right to control their entire workday (say, eight hours). The remaining four hours of work constitute surplus labor time, during which the worker continues to create value, but receives no equivalent compensation. This unpaid labor is the exclusive source of the surplus value appropriated by the capitalist.

The concept of abstract labor is more than just an accounting technique; it acts as Marx’s essential analytical tool, transforming the economic description into a profound social critique. By homogenizing all human effort into abstract labor-time, Marx argued that value is fundamentally a social relation that manifests in the market exchange of privately produced commodities. This transformation from specific, concrete toil to abstract, undifferentiated value enables the capitalist system to function and maximize surplus extraction.[Read]

Consequently, the LTV is indispensable because it maintains the premise that labor and labor alone creates value. This allows Marx to define exploitation not as a moral outrage over low wages (transactional exploitation), but as a structural property of capitalism. Exploitation is the necessary separation of the worker from the means of production, forcing the sale of labor power and leading to the systemic, legal appropriation of the resultant surplus value by the owning class.

The Subjectivist Storm: Marginal Utility and the Modern Reckoning

Despite the structural elegance of the Marxist framework, the Labor theory of value faced a decisive challenge in the late 19th century, marking a profound shift in mainstream economic thought. This change is historically known as the Marginal Revolution.

The Rise of Subjective Value

Classical economists sought an objective measure of value, rooted in production costs. The Marginal Revolution, spearheaded independently by thinkers like William Stanley Jevons, Léon Walras, and Carl Menger, departed entirely from this approach.[Read] They advanced the subjective theory of value (STV), arguing that the value of a good is not determined by the labor required to produce it, but instead by the subjective preferences and individual value judgments of the people who demand it. In essence, a good’s value depends on what someone is willing to pay for it.

The STV provided an immediate, elegant solution to the unresolved diamond-water paradox that had troubled Adam Smith.[Read]

Marginal Utility and Scarcity

The solution lies in the concept of marginal utility, which measures the utility, or satisfaction, gained from consuming one additional unit of a good. People do not value the world’s entire supply of water against the world’s entire supply of diamonds; rather, they evaluate the utility of the next unit.[Read]

Water, although essential for survival (high total use-value), is abundant. Therefore, the marginal utility of acquiring one extra glass of water is generally very low. Diamonds, conversely, are non-essential but scarce. For many consumers, the marginal utility gained from possessing one additional, rare diamond far exceeds that of one additional unit of ubiquitous water. Consequently, people are willing to pay a much higher price for the diamond.

The Subjective Theory of Value posits that prices drive costs, rather than the reverse. For example, a bottle of fine wine is valuable because people enjoy drinking it and subjectively value the experience highly. This high valuation then makes the land, specialized labor, and machinery used to produce it expensive and worthwhile to procure.

The profound divergence between the LTV and STV is summarized.

Table 2: Labor Theory of Value (LTV) vs. Subjective Theory of Value (STV)

| Basis of Value | Labor Theory of Value | Subjective Theory of Value |

| Source | Socially necessary labor time required for production. | Subjective preferences and consumer demand. |

| Key Metric | Exchange-value derived from embedded labor costs. | Marginal utility of the next unit consumed. |

| Focus of Analysis | Structural production relations and long-run value. | Price formation, scarcity, and allocation optimization. |

| Value Definition | Objective, rooted in expended time/effort. | Relative, rooted in individual desire/scarcity. |

This analysis reveals that the LTV and the STV are fundamentally designed to answer different questions. The LTV aims to define the source of macroeconomic wealth and explain the structural relations of production and exploitation over the long term. The STV, however, focuses on microeconomic allocation and short-run price formation based on psychological preference and scarcity.[Read] Mainstream economics, focused primarily on predicting market equilibrium and optimizing resource allocation, adopted the STV because it is a more effective tool for modeling rapid price fluctuations and short-term decisions.

The LTV’s Persistent Puzzle: Prices of Production and the Transformation Debate

Even within the Marxist tradition, a critical analytical challenge arose regarding the relationship between the theoretical concept of labor value and the empirical reality of market prices. Marx explicitly stated that the market price of a commodity would rarely, if ever, precisely equal its labor value in the short term, largely due to fluctuations in supply and demand. The LTV only predicts that market prices will, over the long run, gravitate around the value determined by SNLT.

The Transformation Process

In Volume III of Capital, Marx addressed how values transform into observable prices in a competitive economy. Competitive capitalism is characterized by the mobility of capital. Capitalists, seeking maximum profit, tend to shift their investments away from sectors with low rates of return and into sectors with high rates of return.[Read] This competitive movement creates a tendency toward an equal rate of profit across all economic sectors.

To realize this average rate of profit, commodities are exchanged not at their direct labor value, but at their production price—defined as the cost of production (constant plus variable capital) plus the average rate of profit.[Read] This shift necessitates a redistribution of the total aggregate surplus value among the capitalist class. Consequently, industries that are highly capital-intensive (high proportion of constant capital, low proportion of variable capital) often sell their goods above their labor value, while industries that are highly labor-intensive (low constant capital, high variable capital) often sell their goods below their labor value.

The Transformation Problem and Consistency

The mechanism described above became the subject of intense controversy known as the “Transformation Problem”. Critics argued that Marx’s method contained an internal inconsistency. Specifically, they claimed that in the transformation process, Marx valued inputs (raw materials and machinery, or constant capital) in terms of their labor value (as established in Volume I) but valued outputs in terms of their production price (Volume III). This approach was criticized as circular, essentially explaining prices in terms of prices, rather than in terms of labor-based value.[Read]

The intensity of the debate over the transformation highlights a key conceptual nuance: the LTV is better viewed as a systemic constraint defining the potential for profit, rather than a computational tool for predicting individual prices.[Read] The theory defines the total aggregate value and total aggregate surplus available in the economy, setting the ultimate limit on how much profit can be distributed, regardless of how market prices redistribute that profit pool among competing firms.

The Temporal Single System Interpretation (TSSI)

In the late 20th century, a group of scholars developed the Temporal Single System Interpretation (TSSI) as a robust defense of the internal consistency of Marx’s theory.[Read] TSSI advocates argue that the traditional critique rested on a misinterpretation, specifically a “simultaneous” valuation of inputs and outputs.[Read]

The TSSI insists that Marx’s framework must be interpreted dynamically and temporally. Under this view, input prices—the costs of raw materials and machinery purchased by the capitalist—are measured at the historical moment they were acquired, not simultaneously with the determination of the final output price.[Read] By utilizing historical costs, the TSSI maintains that value and price, while distinct, are determined interdependently within a single system, thus breaking the alleged circularity.[Read] This interpretation not only defends Marx’s consistency but also supports his critical claims, including the controversial law of the tendency of the rate of profit to fall.[Read]

Labor Value in the 21st Century: Gig Workers and Global Supply Chains

Although largely sidelined in mainstream academic economics, the structural framework provided by the Labor theory of value remains an invaluable analytical tool for political economists and sociologists studying modern labor dynamics and global economic inequality.

The Gig Economy and the Abstraction of Labor

The emergence of the ‘gig economy’—characterized by digital platforms like Uber and Deliveroo acting as market intermediaries and “shadow employers”—presents a complex capital-labor relationship ripe for LTV analysis.[Read] Applying Labor Process Theory (LPT), a Marxist approach, helps reveal the core mechanism driving profit extraction in this new landscape.

Digital platforms thrive by achieving the maximum possible abstraction of labor. They standardize and quantify tasks, often codifying them into lists or rules that can be monitored by algorithms, effectively rendering the worker an interchangeable, deskilled part. This hyper-standardization maximizes control over abstract labor and minimizes the socially necessary labor time required for each gig. By minimizing the time necessary to complete a task, the platform intensifies the production of surplus value per unit of time worked. This mechanism demonstrates that the LTV’s conceptual tools remain highly relevant for dissecting contemporary business models built on labor arbitrage and technological control.

Global Supply Chains and the Planetary Labor Market

The LTV also offers profound insights into the operation of global supply chains. Marx argued that capital inherently strives to overcome every spatial barrier and “annihilate space by time,” making the creation of rapid transport and communication links a fundamental necessity.[Read] Today’s complex global supply chains are the realization of this drive, engineered systems optimized for the global extraction of surplus value.

These chains enable the establishment of a “planetary labor market” by strategically leveraging geographical differences in labor costs, productivity standards, and regulation. By sourcing inputs and executing production in locations where the value of labor power (wages) is low relative to the value created, multinational capital effectively reduces the global SNLT required for production and maximizes the global rate of surplus value.[Read] This structural advantage confirms the LTV’s central proposition about the unequal power dynamic between capital and labor on a worldwide scale.

Value, Capital, and Sustainability

The conceptual architecture of the LTV also influences how we understand long-term economic sustainability. Organizations like the World Bank increasingly measure national success not just by GDP flow but by the stock of total wealth, encompassing produced capital, natural capital (forests, resources), and human capital (the workforce and its skills).[Read]

The LTV framework provides a crucial structural interpretation of this wealth assessment. Human capital—the stock of skilled, able workers—is analogous to Marx’s variable capital: the capacity to create future value. When a society depletes its natural resources or fails to invest in the education and health of its workers, it reduces the qualitative and quantitative capacity of its variable capital. This decline jeopardizes the possibility of generating future surplus value and undermines the long-term sustainability of wealth creation, affirming the LTV’s underlying concern with the social reproduction of labor as the ultimate basis of economic existence.

Decoding Economic Value: Frequently Asked Questions (FAQ)

Q. What is socially necessary labor time (SNLT)?

Socially Necessary Labor Time (SNLT) is the average amount of homogeneous labor time required to produce a specific commodity under the average prevailing social, technical, and productive conditions in society. It dictates that a commodity’s value is determined by the average productivity level, not by the amount of time any individual, inefficient producer might spend.

Q. How does the Labor Theory of Value define exploitation?

Under the Labor theory of value, exploitation is defined as the structural mechanism inherent in capitalism where the capitalist appropriates surplus value. Surplus value is the difference between the total value a worker produces during their working day and the value of their labor power (which is covered by their wages). Exploitation thus stems from the compulsory, unpaid labor performed by the worker beyond the point necessary to reproduce their own wages.

Q. What is the difference between constant and variable capital?

Constant capital © refers to the value transferred from non-human means of production, such as machinery, tools, and raw materials, often called dead labor. It transfers existing value but creates no new value. Variable capital (V) is the expenditure on wages for the workers (living labor). It is considered “variable” because it is the only input capable of generating new value, specifically the surplus value appropriated by the capitalist.

Q. Why did mainstream economics reject the LTV in favor of marginal utility?

Mainstream, or neoclassical, economics rejected the Labor theory of value in the late 19th century because the Subjective Theory of Value (STV) and the concept of marginal utility proved more effective at explaining observed price formation, resource allocation under conditions of scarcity, and consumer behavior. STV successfully solved the classical dilemma of the diamond-water paradox, a problem the LTV could not adequately address.

Q. What is the Transformation Problem in Marxist economics?

The Transformation Problem addresses the question of how labor values, which determine the aggregate pool of surplus value in the economy, translate into market prices, specifically production prices, in a competitive capitalist system. Competition drives an equalization of the rate of profit across different industrial sectors, requiring commodities to exchange at prices that necessarily diverge from their individual labor values.

Conclusion: The Value of Vision

The Labor theory of value stands as one of history’s most compelling and controversial concepts, having shaped political thought, labor movements, and economic policy debates for two centuries. From its cautious articulation by Adam Smith to its revolutionary development by Karl Marx, the theory forces a rigorous intellectual investigation into the fundamental nature of economic worth.

While the modern era, dominated by the subjective theory of value and marginal utility, uses alternative models to predict short-term price fluctuations and optimize resource allocation, the LTV retains unparalleled power as an analytical framework. It provides the necessary macro-monetary theory to define the ultimate source and limits of new wealth created within capitalism. Moreover, its continued utility in analyzing modern phenomena—from the structural exploitation inherent in the highly abstracted labor of the gig economy to the vast geographic imbalances embedded in global supply chains—underscores its critical relevance.

The LTV is not simply an exercise in economic accounting; it is a profound ethical challenge. It demands that we look beyond transactional market prices and ask a deeper question about the structural distribution of power: Whose labor created the wealth that sustains society, and who structurally benefits from the uncompensated effort of others? Reconsidering the Labor theory of value offers not just historical context, but an indispensable lens for evaluating the fairness and sustainability of contemporary economic relations. It compels every sophisticated observer of the global market to recognize that human endeavor remains the astonishing, foundational secret of economic worth.

Engage with our curated reflections on Money, Design, and Society—crafted for discerning minds. Share your perspective, and become part of a dialogue that shapes tomorrow’s world.