Table of Contents

The New Era of Entrepreneurship

The rush of creative success often masks a harsh financial reality: the thrill of viral content quickly turns into the anxiety of variable income. If you are building a thriving digital audience, you are not just a creator; you are the CEO of a rapidly scaling enterprise. Mastering creator economy finance transforms vulnerability into resilient, predictable wealth.

For millions, the digital landscape represents an unprecedented opportunity to monetize passion and personality. However, the transition from a celebrated hobbyist to a strategic business owner demands a complete professional overhaul, particularly concerning financial architecture. This article provides the expert blueprint necessary for navigating the unique volatility of digital earnings, ensuring stringent compliance, and establishing the groundwork for lasting financial freedom.

The greatest creative talents frequently fail to achieve long-term financial stability not because of a lack of audience, but because of a lack of robust financial systems. Building a sophisticated, protected business structure is the ultimate act of creative sustainability.

The Billion-Dollar Blueprint: Why Creators Are the New Moguls

The creator economy finance discussion must begin by recognizing the sheer scale and velocity of the market. This industry has fundamentally shifted from a collection of individual side hustles into a global economic powerhouse.

The Velocity of Digital Wealth

The global creator economy market was estimated at a robust USD 205.25 billion in 2024. More compelling than its current size is its projected trajectory. This market is not simply stable; it is accelerating at a breathtaking pace, projected to reach USD 1,345.54 billion by 2033, demonstrating a compound annual growth rate (CAGR) of 23.3% from 2025 onward.[Read] This explosive growth is largely fueled by the rising consumer demand for personalized content and the rapid proliferation of direct-to-fan monetization models.

This high-speed growth environment creates complex financial challenges that traditional employment models never faced. When an industry expands this quickly, the risk of financial mismanagement and non-compliance among its core participants also escalates.

The Ecosystem of Earnings and Concentrated Risk

Within this burgeoning ecosystem, individual content creators dominate the landscape. They account for the largest revenue share, leading the market with 58.7% of the total revenue in 2024. This figure is critical because it reveals where the primary financial risk resides: with the solopreneur, not the large media company. The financial burden—instability, cash flow gaps, and compliance confusion—is highly concentrated among the people least likely to have enterprise-grade finance teams.

Platforms are segmented heavily, too, reflecting where the money moves. The video streaming segment accounted for the largest platform revenue share in 2024, followed closely by advertising, which remains the leading revenue channel overall. This platform preference highlights the immediate need for creators to manage the unique financial logistics associated with ad revenue payouts, which can be inconsistent and subject to algorithm changes.

The heavy reliance on advertising as the leading revenue channel creates fundamental fragility. Platform decisions and global advertiser budgets are external, volatile factors that link a creator’s success to forces entirely outside their control. To counter this, financial strategies must prioritize internal controls and self-insurance mechanisms to build a financial moat around the business. As the influential Chef Ranveer Brar noted, “Until you start behaving like a brand, a brand will not take you seriously”.[Read] A true brand builds infrastructure, and that begins with impeccable financial organization.

Taming the Volatility: Managing Income as a Content Creator

The most immediate and pervasive challenge for creators is the inconsistent and variable nature of income. One viral month might yield significant revenue, followed by a lean period where earnings drop precipitously. Effectively managing income as a content creator requires moving away from reactive budgeting toward proactive cash flow management.

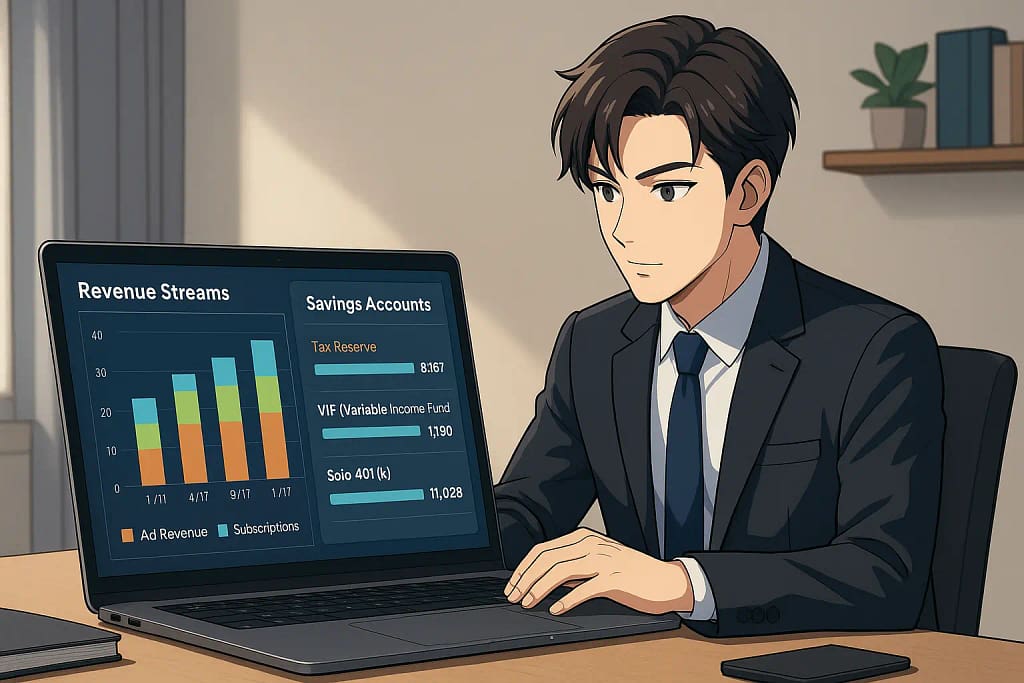

The Variable Income Fund (VIF) Strategy

A critical tool for stabilizing personal finance is the implementation of a Variable Income Fund (VIF). This fund is designed to absorb the shocks of high-low earning cycles. During months when earnings exceed projections, the creator must immediately save the surplus income into the VIF.[Read]

Ideally, the VIF should cover at least six months of combined financial obligations: personal living costs, essential business operating expenses, and tax liabilities. The VIF allows the creator to pay themselves a consistent, predictable “salary,” even when business revenue declines, stabilizing household cash flow and reducing the intense cognitive load associated with financial uncertainty. When income naturally ebbs and flows every month, there is significantly less latitude for financial errors.

Budgeting with Precision and Practical Tools

Traditional budgeting often struggles with variable income because it relies on forecasting future earnings, which is nearly impossible for content creation. Specialized budgeting software designed for inconsistent earnings provides a solution. Tools like YNAB (You Need A Budget) utilize a zero-based methodology, focusing only on allocating the funds the creator has already earned, providing real-time financial clarity.

To further smooth out operational expenses, creators can implement the “half-payment method” for large, irregular bills, such as annual software subscriptions, quarterly insurance payments, or semi-annual hosting fees. By setting aside half of the required amount each month, the financial impact of the bill is distributed evenly throughout the year, preventing large drawdowns during lean months. These automated, rule-based systems depersonalize cash flow management, transforming emotionally driven spending decisions into systematic, reliable operations.

The Foundation of Prosperity: Structure, Banking, and Business Credit

To transition from a freelancer to an entrepreneur, the creator must establish a professional business infrastructure that provides legal protection and maximizes financial efficiency.

Legal Shields: Choosing the Right Business Entity

For a creator earning substantial revenue, operating merely as a sole proprietorship is highly risky. A sole proprietorship offers simplicity but exposes personal assets to business liabilities.[Read] The formation of a Limited Liability Company (LLC) is an essential foundational step, providing a necessary legal shield that separates personal wealth from business debts and legal risks.

The LLC structure also offers remarkable flexibility in taxation. While a single-member LLC is typically taxed by default as a sole proprietorship, the owner can later elect to be taxed as an S corporation. For high-net-income creators, this election can be a powerful strategy to potentially optimize tax obligations on owner distributions, making the LLC the ideal legal structure for a growing digital enterprise.

Global Accounts for Global Reach: The FinTech Advantage

The income streams of a typical creator are diverse, originating from platforms like AdSense, Patreon, brand deals, and global digital product sales. Managing international payments, currency conversions, and platform fees through traditional banks can be cumbersome and expensive.

FinTech platforms offer superior solutions for handling this complexity. Unlike banks that often charge excessive wire transfer fees or use unfavorable conversion rates, platforms such as Wise or Payoneer provide transparent pricing, real-time exchange rates, and multi-currency accounts, ensuring the creator retains a greater percentage of their global earnings.[Read] These services are faster, more cost-effective, and designed specifically to meet the needs of the digitally mobile workforce.

Furthermore, specialized banking and payment solutions are beginning to automate the creator’s most difficult administrative task: tax compliance. Some platforms can automate tax estimation alerts after a major sale, such as an NFT transaction, eliminating year-end surprises.[Read] Others, like Borderless, automate the collection of necessary compliance paperwork, such as W9s, and auto-issue 1099 forms in the United States, significantly simplifying regulatory adherence.[Read]

Strategic Use of the Creator Economy Business Credit Card

Using a dedicated creator economy business credit card is more than a mechanism for purchasing; it is a critical tool for financial hygiene and tax preparation. By running 100% of business expenses through this single account, creators create an instantaneous, auditable record for tax deductions, substantially increasing the accuracy of their financial reporting.

Selecting the right card is crucial for maximizing rewards on core operational costs. Cards tailored to small business owners, such as the Ink Business Preferred Credit Card, often offer high rewards multipliers—for instance, 3X points—on categories that are essential to the creator workflow. These valuable categories typically include advertising purchases made with social media sites and search engines, internet and phone services, and travel.[Read] This strategic optimization turns necessary overhead into a source of ongoing value.

The table below summarizes the critical technology adoption required for modern creator finance: Essential FinTech Tools for Global Creator Finance

Financial Need | Recommended Solution Feature | Business Benefit |

| Variable Income Management | Automated Tax Set-Asides (FinTech banking) | Eliminates year-end tax surprises and penalties. |

| Global Payments/FX Rates | Multi-Currency Accounts (Wise, Payoneer) | Reduces fees and leverages real-time exchange rates. |

| Platform Ad Spend/Subscriptions | Virtual Business Credit Cards | Improves expense categorization and tracking. |

| Compliance & Reporting | Automated W‑9/1099 Collection (Borderless) | Simplifies year-end tax filing and regulatory adherence. |

Tax Tips for Freelancers and YouTubers: Compliance and Deduction Mastery

Financial stability cannot be achieved without rigorous tax planning. Most creators quickly discover they face a dual tax burden that traditional W‑2 employees never encounter. This demands systematic financial discipline.

Navigating the Dual Tax Burden

The essential starting point for tax tips for freelancers and YouTubers is understanding the two layers of obligation. First, creators owe standard federal income tax based on their annual profitability. Second, and often far more surprising, is the hefty 15.3% Self-Employment (SE) tax levied on their net creator income.[Read] This SE tax is the equivalent of the employer and employee portions of Social Security and Medicare combined, and it is the single most significant factor in year-end tax shortfalls.

To mitigate penalties and interest, professional creators anticipating owing $1,000 or more annually must diligently pay estimated quarterly taxes. These payments are due four times per year: April 15, June 15, September 15, and January 15.

The Quarterly Commitment and the 30% Rule

Calculating estimated taxes can be complex, especially with fluctuating monthly revenue. A simplified, universally applicable method for immediate cash flow management is to employ the “30% Rule”. A creator should set aside 30% of their net creator income (revenue minus expenses) for tax obligations. This provides a prudent buffer generally sufficient to cover the federal income tax, the self-employment tax, and potential state obligations. This process should be automated using separate savings accounts to prevent accidental spending.

For creators with highly unpredictable income swings or those earning over $150,000, a more advanced approach is the “Safe Harbor” strategy. This method avoids underpayment penalties by simply matching your previous year’s total tax payment and spreading that amount across the four quarters. If the previous year’s adjusted gross income (AGI) exceeded $150,000, the safe harbor requirement increases slightly to 110% of the prior year’s liability, ensuring compliance even if income unexpectedly spikes.

Maximize Your Deductions

Since the 15.3% self-employment tax is levied on net income, rigorous tracking and maximization of business deductions are critical to legally reducing the tax burden. Every purchase made with a genuine business purpose must be documented and receipts meticulously saved.

Key categories of deductible expenses for creators include:

Equipment and Technology: The full cost of assets like cameras, professional lighting, microphones, computers, and editing software purchased during the tax year is generally deductible.

Platform and Software Costs: All recurring subscriptions, including analytics tools, scheduling platforms, website hosting fees, and cloud storage, qualify as necessary business expenses.

Professional Development: Expenses related to improving skills, such as attending creator conferences, purchasing online courses, or hiring business coaches, are deductible.

Your Workspace: The home office deduction is available, provided the space is used exclusively and regularly for business purposes. The distinction is paramount: if the “studio” doubles as a guest room, the deduction is typically invalidated by IRS rules.

Beyond the Sponsor: Strategic Revenue Diversification

The concentration of risk in advertising and platform-dependent algorithms mandates that creators move toward layered, resilient revenue models. Diversification is the creator’s ultimate hedge against platform risk.

The Layered Income Model

The industry is rapidly shifting away from relying solely on one-time payments and sponsorships toward building recurring income streams. This trend creates greater financial predictability.[Read] Creators who successfully layer their business models generate stronger, more predictable earnings and enhance audience loyalty.

Effective diversification strategies include:

Subscriptions and Memberships: Offering tiered access to exclusive content or premium community features generates reliable revenue stickiness, transforming audience attention into consistent monthly income.

Digital Products and Branded Apps: Leveraging expertise to sell online courses or exclusive content via creator-owned apps provides dependable revenue that is less vulnerable to external sales fluctuations. Converting one-time course sales into a subscription model, for instance, maintains audience engagement and long-term investment.

Affiliate Marketing and Merchandising: These sources leverage existing audience loyalty directly into sales, providing revenue streams that operate independently of platform ad policy.

Financial Philosophy and Ethical Monetization

While integrating advertisements can yield “big money,” Madan Gowri emphasizes that creators must carefully balance monetization with audience trust. If every piece of content is perceived as purely paid, viewers will disengage. Ethical monetization requires transparency and an alignment of sponsored content with the creator’s values. As Sakshi Sindwani advises, creators should “only collaborate with brands that you resonate with and learn to say no”.

Furthermore, creators must protect their financial interests when dealing with third parties. Aayush Tiwari from Monk Entertainment warns that unmanaged creators are sometimes pressured into signing binding contracts or documents simply to clear invoices. Vigilance in reviewing all financial and legal documentation is non-negotiable for safeguarding the business.

Securing Tomorrow: Investing for Content Creators and Retirement Planning

The final pillar of resilient creator economy finance is the shift from managing cash flow to accumulating long-term, tax-advantaged wealth. Creators must actively seek strategies for investing for content creators that counterbalance the inherent volatility of their primary business income.

Low-Risk Paths to Passive Income

Since the business of content creation is often high-risk and dependent on competitive factors, the personal investment portfolio should frequently prioritize stability. Diversifying investments outside of the digital sphere can act as a financial counterweight, balancing aggressive business growth with steady, reliable returns.[Read]

Bonds serve this crucial purpose. When a creator purchases a bond, they are lending money to a government or corporation in exchange for steady interest payments. Bonds are considered lower risk compared to stocks and provide a predictable income stream over time. Investing in diversified bond funds further spreads this risk, contributing a foundational layer of stability to the creator’s long-term wealth strategy.

The Long Game: How to Save for Retirement as a Freelancer

Maximizing tax-advantaged retirement contributions is arguably the most powerful long-term strategy available to high-income self-employed individuals. Creators must move beyond simple savings accounts and leverage specialized retirement vehicles designed for the solo entrepreneur.

The two most popular options are the SEP IRA (Simplified Employee Pension) and the Solo 401(k). The choice depends heavily on the creator’s net income and administrative capacity. The Solo 401(k) generally offers the potential for higher contribution limits, making it the preferred vehicle for highly profitable creators. This plan allows the owner to contribute in two capacities: as an ’employee’ and as an ’employer’. For 2024, this structure permitted total combined contributions up to $69,000, with an additional $7,500 catch-up contribution for those aged 50 and over. While the Solo 401(k) requires slightly more administrative management, it provides maximum tax deferral power and may even offer loan options.[Read]

In contrast, the SEP IRA is simpler to set up but limits contributions strictly to the ’employer’ portion, typically capped at 20% to 25% of net income. It does not offer the higher contribution maximums or loan options found in the Solo 401(k). The complexity of the Solo 401(k) is offset by its superior capacity for rapid wealth accumulation, making it an essential component of how to save for retirement as a freelancer.

Side-by-Side: Retirement Options for the Independent Creator

| Feature | Solo 401(k) | SEP IRA |

| Maximum 2024 Contribution | Up to $69,000 (Employee + Employer) | Up to 25% of Net Income (Employer Only) |

| Catch-Up Contribution( Age 50+) | Yes ($7,500) | Typically No |

| Loan Options | May Offer Loans | No Loan Options |

| Administrative Complexity | Higher (Requires detailed management) | Lower (Simpler setup) |

| Ideal For | High-income creators seeking maximum tax deferral | Simplicity and ease of use, earlier-stage businesses |

Frequently Asked Questions (FAQ)

What is the creator economy?

The creator economy refers to a rapidly growing digital industry where individuals—including influencers, YouTubers, artists, and writers—leverage digital platforms to produce and monetize content. Creators earn income through diverse sources such as brand partnerships, ad revenue, subscriptions, and digital product sales, effectively transforming their passion into a sustainable career.[Read]

How much tax should a content creator set aside for quarterly payments?

Most professional content creators should set aside approximately 30% of their net creator income for tax obligations. This percentage is generally sufficient to cover both federal income tax and the 15.3% Self-Employment tax. Estimated payments are required quarterly (April 15, June 15, September 15, and January 15) if the creator expects to owe $1,000 or more annually.

Should a full-time content creator form an LLC or remain a sole proprietor?

A full-time creator generating significant revenue should strongly consider forming a Limited Liability Company (LLC). While a sole proprietorship is simpler to start, the LLC provides essential legal separation, protecting the creator’s personal assets from business liabilities. Furthermore, an LLC offers advantageous flexibility, allowing the creator to later elect to be taxed as an S corporation for potential tax optimization.

How can content creators receive international payments without losing money on fees?

Content creators should utilize specialized FinTech platforms such as Wise or Payoneer instead of traditional banks. These platforms offer transparent pricing, utilize real exchange rates, and charge significantly lower fees for multi-currency transactions and international bank withdrawals. This optimization ensures creators retain more of their global earnings.

What is the biggest financial mistake creators make?

The biggest financial mistake creators make is failing to separate business and personal finances, often underestimating the severity of tax obligations, particularly the 15.3% Self-Employment tax. This lack of separation leads to unpredictable cash flow, missed quarterly tax payments, and the failure to build sufficient financial safety nets like the Variable Income Fund.

Conclusion: The Financial Architect of the Creator Economy

The journey through the financial landscape of the creator economy finance market is ultimately a passage from artist to architect. We have examined the massive market potential, the critical strategies for managing volatile daily income, the necessity of sophisticated tax compliance, and the mandate for building long-term, resilient wealth through diversification and specialized retirement planning.

Financial stability is not the ultimate ceiling of creative success; it is the essential, fortified floor upon which extraordinary careers are built. By professionalizing their financial lives, creators transition from being subjects of algorithmic volatility to masters of their own destiny. Take control of your cash flow, optimize your tax position, and architect a financial structure that guarantees your creative freedom for decades to come. The most valuable content you will ever create is a predictable, resilient financial life. Begin building that resilient foundation today.

Engage with our curated reflections on society, design, and economics—crafted for discerning minds. Share your perspective, and become part of a dialogue that shapes tomorrow’s world.